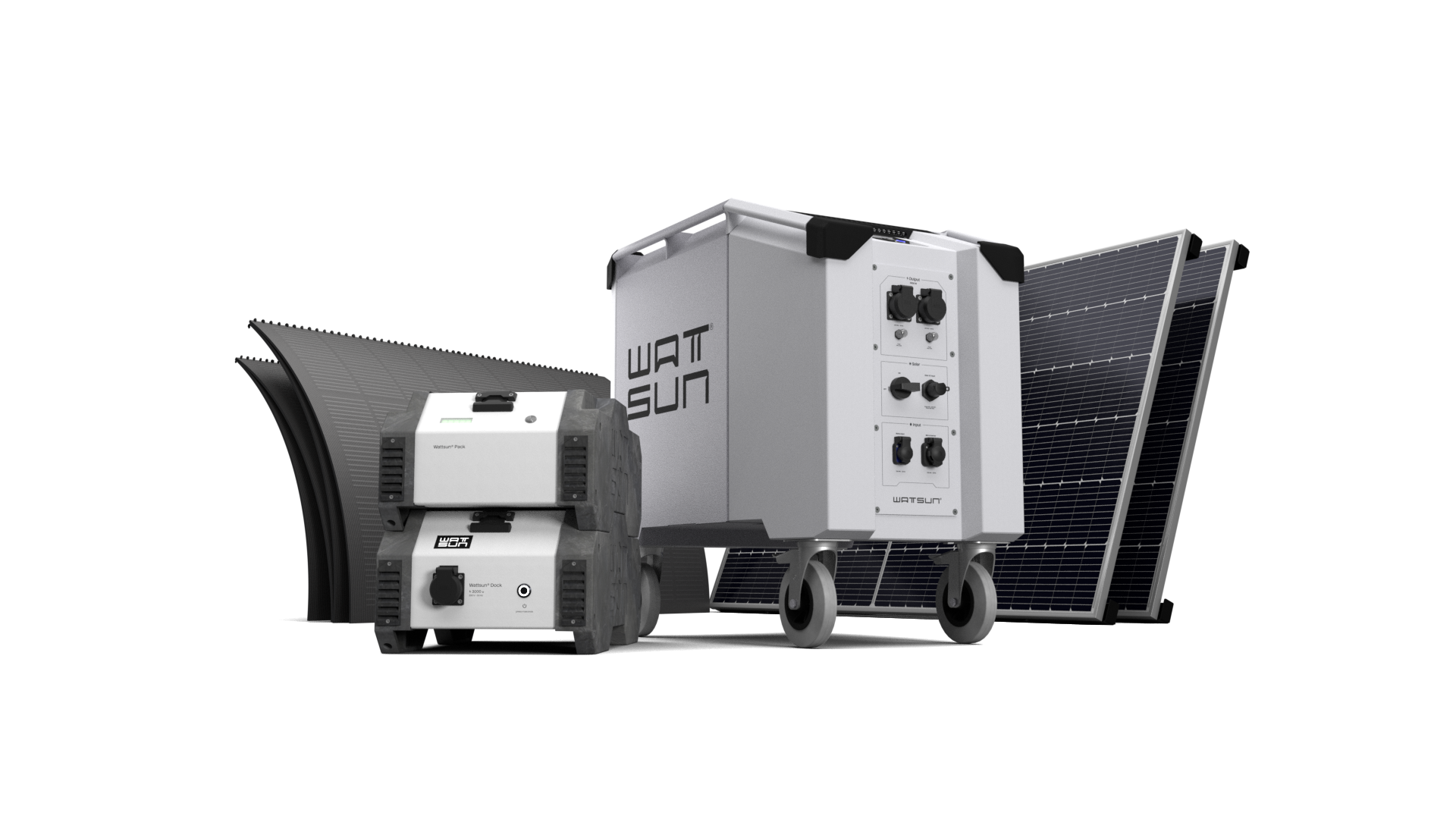

Tax benefit for sustainable investment

If you, as a Dutch company, purchase a portable battery system from Wattsun, you qualify for the Environmental Investment Allowance (MIA) in 2025. This is a fiscal arrangement that allows you to achieve tax advantages when investing in environmentally friendly assets. At our request, the Netherlands Enterprise Agency (RVO) has included portable battery systems on the environmental and energy list (A4316), making Wattsun’s products 36% deductible.

Note: This arrangement is specifically created for mobile battery systems like those from Wattsun. Fixed battery packs from other providers do not qualify for the MIA scheme.

Wattsun solar panels are also deductible

Some of our customers purchase our battery system along with the Wattsun Solarkit, for example, to make break rooms and company vans more sustainable. This package is also covered by the MIA scheme. The RVO states that solar panels ‘exclusively serving the battery pack’ qualify for this. Since our solar panel connectors are specially developed for our battery system, the Solarkit is fully deductible in tax returns.

Why is Wattsun eligible?

The Netherlands Enterprise Agency has added Wattsun’s battery systems to the MIA because, according to the RVO, our products contribute to ‘reducing greenhouse gases, promoting energy transition, limiting noise pollution, and improving air quality.’